In the fast-evolving terrain of cryptocurrency mining, Dash reigns as a unique player—balancing speed, security, and anonymity. For miners and hosting services aiming to amplify profit margins, understanding the nuanced role of hardware performance is key. It’s not merely about spinning up hashing power; it’s about harmonizing efficiency, electricity consumption, and resilience while navigating Dash’s distinct hashing algorithm, X11. Through this prism, profit maximization becomes a dance of precision rather than sheer brute force.

Dash mining diverges from Bitcoin’s SHA-256; here, the X11 algorithm requires hashing sequences across eleven different algorithms, creating more complex computational demands. This intricacy mandates mining rigs to possess a balanced combination of computational throughput and energy efficiency, especially as the competitive mining difficulty escalates. For mining rig manufacturers and hosting operators, an intimate grasp of how the hardware copes with these layered hashing steps can make or break profitability.

Efficiency must be examined on two forefronts. First, at the microarchitecture level: ASIC miners designed explicitly for X11 yield unparalleled efficiency compared to GPU-based rigs, which, while flexible, often sock away more power per unit of output. Second, at the macro infrastructural level: hosting environments equipped with robust cooling solutions and renewable energy sources can substantially trim operating overhead. Organizations that manage to meld state-of-the-art ASICs with optimized hosting environments rightfully witness superior return on investment (ROI) trajectories.

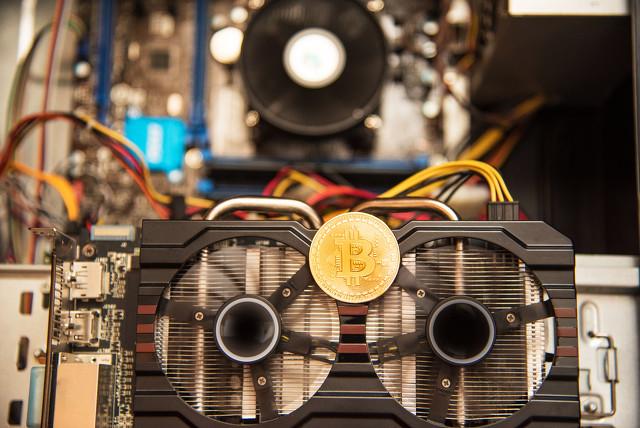

Consider the decision-making calculus between deploying long-standing GPU farms versus upgrading to custom-built ASICs engineered for X11. GPUs, although versatile and reprogrammable for various algorithms such as Ethereum’s Ethash or even Dogecoin’s Scrypt, generally lag in hash rate per watt for Dash mining. This translates directly into increased operational costs and diminished margins due to the energy-intensive nature of multi-stage hashing. ASIC machines, conversely, deliver laser-focused performance enhancements but necessitate upfront capital expenditures and deeper technical insight to operate without hiccups.

From a hosting perspective, latency and uptime also play pivotal roles. Dash miners thrive in environments where connectivity to mining pools is stable, minimizing downtime and maximizing block rewards. Hosting providers are thus compelled to engineer redundant network pathways and climate-controlled data centers tailored for heat-intensive ASIC deployment. Additionally, the potential integration of smart monitoring systems harnessing IoT devices ensures real-time hardware diagnostics, enabling swift interventions before a minor issue snowballs into expensive downtime.

Yet, hardware prowess alone doesn’t guarantee profitability. Sophisticated firmware optimization—balancing core frequencies, voltage levels, and hash intensity—can push a moderately powerful machine beyond its vanilla specifications. Miners who exploit custom firmware or overclocking strategies (while carefully managing thermal limits) often claw out incremental gains invisible to off-the-shelf deployments. Likewise, pooling strategies demand attentiveness; mining on pools with lower fees and frequent payouts can complement hardware efficiency to bolster earnings.

Security is another frontierscape. Dash’s incentivized master node system indirectly impacts network dynamics and block validation speed, hence influencing mining rewards. Staying updated with protocol upgrades and compatible mining software ensures that hardware isn’t left underperforming due to network irregularities. Hosting services facilitating seamless updates and proactive patch management fortify both user trust and system integrity, all crucial components in the continual profitability quest.

Adaptive scalability also defines next-level profit models. Early investments in modular mining rigs allow incremental expansion as coin market dynamics shift. Hosting firms offering modular rack solutions provide clients a flexible pathway to scale operations without incurring large downtime. This elasticity remains vital as Dash’s market value oscillates, and mining difficulty adjusts correspondingly, demanding nimble recalibration between hashing power and operational expenditure.

Lastly, embracing sustainability serves dual incentive mechanisms—cost savings and corporate responsibility. Running green-powered mining farms reduces exposure to volatile electricity tariffs while aligning with growing environmental scrutiny. Forward-thinking miners and hosts increasingly incorporate solar and wind energy, leveraging hybrid power systems to stabilize input costs, reaffirm sustainability credentials, and potentially leverage tax incentives or carbon credits.

In essence, mastering hardware performance in Dash mining is an intricate interplay of technology, operational strategy, and environmental prudence. Profit maximization here defies simplistic metrics, inviting a holistic approach intertwining ASIC hardware selection, mining rig optimization, hosting environment refinement, and vigilant operational oversight. As Dash continues to cement its position in the privacy-centric cryptocurrency niche, those who decode the subtleties of hardware efficiency hold the upper hand in reaping sustained profits amidst a competitive, evolving ecosystem.

This insightful review on Dash mining hardware uncovers surprising profit boosters, like optimized GPU tweaks that defy expectations, blending tech depth with strategic unpredictability for miners seeking an edge.