The allure of cryptocurrency, particularly Bitcoin, Ethereum, and even meme coins like Dogecoin, has captured the imagination of investors worldwide. But beyond the digital exchanges and fluctuating price charts lies a hardware-driven industry that powers the entire system: cryptocurrency mining. For a French investor looking to delve deeper into this space, understanding Application-Specific Integrated Circuit (ASIC) miners is crucial. These specialized machines, far removed from your average desktop computer, represent the cutting edge of cryptographic computation and the gateway to participating directly in the blockchain’s validation process.

ASIC miners are purpose-built devices designed exclusively for solving the complex mathematical problems that secure cryptocurrency networks. Unlike general-purpose computers, their architecture is optimized for a single task: hashing. This focused design grants them unparalleled efficiency, allowing them to perform orders of magnitude more calculations per second than CPUs or GPUs. This performance translates directly into a higher probability of successfully mining a block and receiving the associated cryptocurrency reward.

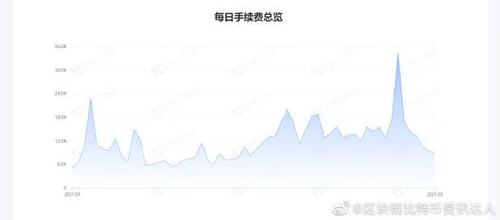

The Bitcoin network, secured by the SHA-256 hashing algorithm, is dominated by ASIC miners. This is due to the immense computational power required to compete for block rewards. Investing in Bitcoin ASICs demands careful consideration of factors like hash rate (the speed at which the miner performs calculations), power consumption, and the current Bitcoin mining difficulty. Newer, more efficient models are constantly being released, rendering older generations obsolete relatively quickly. A crucial aspect for French investors is considering the electricity costs in France, as high power consumption can significantly impact profitability.

While Bitcoin ASICs are the most well-known, other cryptocurrencies also utilize ASIC miners, albeit often with different algorithms. Litecoin, for example, uses the Scrypt algorithm. However, Ethereum’s transition to Proof-of-Stake (PoS) has effectively eliminated the need for Ethash-based ASICs, rendering previous investments in Ethereum mining hardware obsolete. This underscores the inherent risk associated with investing in mining hardware: the potential for technological obsolescence and algorithm changes that can render equipment worthless.

For French investors, the decision to purchase and operate ASIC miners is often intertwined with the concept of mining farms or hosting services. Setting up a mining farm requires significant capital expenditure, not only for the miners themselves but also for infrastructure: specialized cooling systems, reliable power supplies, and secure data centers. Hosting services, on the other hand, offer a more accessible entry point, allowing investors to rent space and power within an existing mining facility. This approach reduces the upfront investment and alleviates the burden of managing the complex technical aspects of running a mining operation. Choosing the right hosting provider, with competitive electricity rates and a robust infrastructure, is paramount.

The volatility of cryptocurrency markets adds another layer of complexity to the ASIC mining equation. The profitability of mining is directly linked to the price of the cryptocurrency being mined. A sudden price drop can significantly reduce revenue, potentially rendering the mining operation unprofitable. Therefore, a thorough understanding of market dynamics and risk management is essential for any French investor considering ASIC mining. Furthermore, the regulatory landscape surrounding cryptocurrency mining is constantly evolving, and investors must stay informed about any relevant legal and tax implications in France.

Beyond Bitcoin, the allure of mining extends to other digital assets. While Dogecoin is primarily mined using Scrypt-based ASICs (often alongside Litecoin), its price fluctuations are heavily influenced by social media trends and celebrity endorsements, making it a particularly risky investment. Understanding the underlying technology and market forces driving each cryptocurrency is crucial before investing in specialized mining hardware. Some alternative cryptocurrencies are resistant to ASIC mining, utilizing algorithms designed to favor GPU mining and promote decentralization. This highlights the importance of thorough research and due diligence before committing capital to any specific mining hardware or cryptocurrency.

Before jumping into the world of ASIC miners, French investors should carefully consider their risk tolerance, investment horizon, and technical expertise. Consulting with financial advisors and industry experts can provide valuable insights and help navigate the complex landscape of cryptocurrency mining. Exploring options like joining a mining pool can also mitigate risk by pooling resources and sharing rewards. Ultimately, successful ASIC mining requires a combination of technical knowledge, market awareness, and a strategic approach to risk management.

In conclusion, ASIC miners represent a significant investment opportunity within the cryptocurrency ecosystem. However, the high capital expenditure, technological obsolescence, market volatility, and regulatory uncertainties demand careful consideration. By understanding the intricacies of ASIC technology, the dynamics of cryptocurrency markets, and the legal landscape in France, French investors can make informed decisions and potentially unlock the rewards of this evolving industry. It’s about more than just hardware; it’s about understanding the future of digital finance.

This guide offers a fascinating blend of technical insights and investment strategies, unraveling the complexities of ASIC miners through a French investor’s lens. It delves into hardware efficiency, market trends, and regulatory nuances, making crypto mining accessible yet intellectually stimulating.