In the ever-evolving landscape of cryptocurrencies, the allure of investing in mining machines is undeniably captivating. Among these, Dash mining has garnered attention due to its unique features and potential for profitability. However, as with any investment, it’s crucial to weigh the pros and cons of managed Dash mining machines to truly maximize your returns.

One significant advantage of managed Dash mining machines is the reduction of operational headaches. By outsourcing the management of mining rigs, investors can focus on strategic decisions rather than the nitty-gritty of hardware maintenance. It’s like handing over the keys to a seasoned driver; you can sit back and watch your investment potentially thrive. This aspect is particularly relevant for newcomers to the crypto space who might feel overwhelmed by the technical complexities of mining.

The scalability of managed Dash mining is another tantalizing perk. As demand for profitable cryptocurrencies continues to rise, the ability to seamlessly expand your mining operations can be a game changer. A managed service can often facilitate the rapid deployment of additional rigs, allowing miners to capitalize on market fluctuations without the traditional delays associated with setting up new equipment. This agility can be likened to a seasoned trader deftly navigating market tides, ready to seize opportunities as they arise.

However, with every upside comes a downside. The prevailing critique of managed Dash mining solutions is the associated fees. While you gain the benefit of convenience, these services often come with a price tag that can dent your overall return on investment. It’s a classic scenario: you pay for ease, but at what cost to your profitability? Some may argue that the deduction in profit margins is worth the peace of mind; others may feel that a hands-on approach could yield better results without additional expenses.

The energy consumption of mining machines is another factor that cannot be overlooked. The environmental impact of mining cryptocurrencies, including Dash, has drawn scrutiny. Managed mining services often implement energy-efficient practices to mitigate these concerns, but miners must remain vigilant. It’s essential to consider whether the green initiatives of a hosting service align with personal values and financial goals. In a world increasingly concerned with sustainability, investing in eco-friendly mining solutions is becoming a priority for many.

Moreover, the volatility of cryptocurrency markets is a double-edged sword. While high volatility can lead to soaring profits, it can also spell disaster for investments if not managed correctly. One must consider how a managed Dash mining operation responds to market fluctuations. Are they equipped to adapt their strategies quickly to protect your investment? This lack of control can be disconcerting for traditional investors who prefer a more hands-on approach. Don’t underestimate the psychological toll that can arise from relinquishing control, especially in a field as volatile as cryptocurrencies.

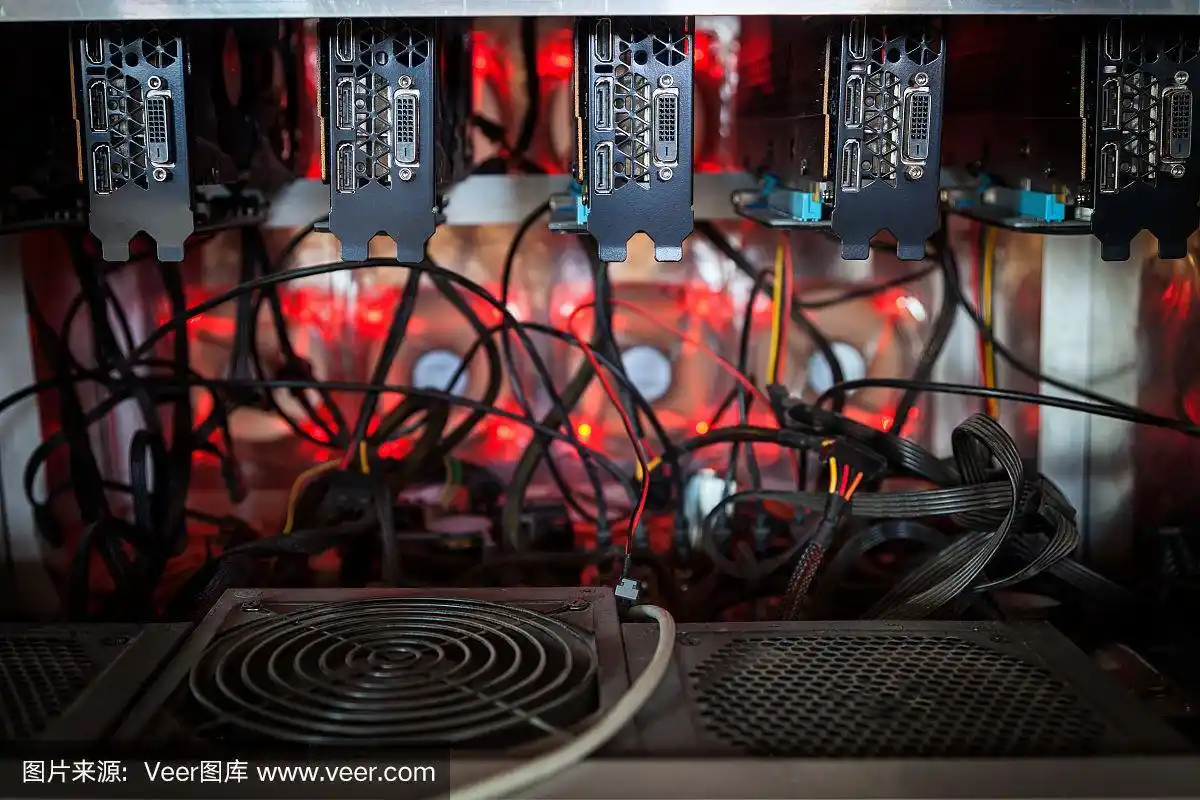

The choice of mining machine is pivotal to the success of your Dash mining endeavor. Managed services typically provide a selection of high-performance rigs tailored for efficiency. However, this brings up the question of transparency: how do you know the conditions of the machines being used? Are they regularly maintained and upgraded? The lack of visibility into hardware performance can be a concern and can lead to anxiety about whether your investment is truly working as hard as it could be.

Regulatory changes can also impact the performance of managed Dash mining. As the cryptocurrency landscape is continually reshaped by government policies worldwide, miners must stay informed about the legal environment. Opting for a managed service can sometimes mean reduced insight into these issues, potentially leaving investors in precarious positions when regulations shift. Educating oneself about the broader context in which your investment operates can be as crucial as examining the machinery itself.

In conclusion, the decision to engage in managed Dash mining machines involves a careful examination of both advantages and drawbacks. The convenience, scalability, and ease of operation are appealing, particularly to those new to the mining scene. Meanwhile, the costs, energy concerns, and potential for diminished control present valid concerns that must not be overlooked. Ultimately, potential investors should do their due diligence, weigh their individual circumstances, and align their choices with their cryptocurrency goals, all while maintaining an adaptable mindset. The journey in mining is as much about learning and adapting as it is about profits, particularly in such a vibrant and unpredictable market.

Managed Dash mining offers convenience but eats into profits with fees. Consider electricity costs and potential for obsolescence against ease of use before investing. Research wisely!